NATIONAL REPORT—Hotel Business is tracking transactions. HFF, Cronheim Hotel Capital (CHC), Mag Mile Capital, Lodging Partners and Walker & Dunlop Inc. have made deals. Here are the details:

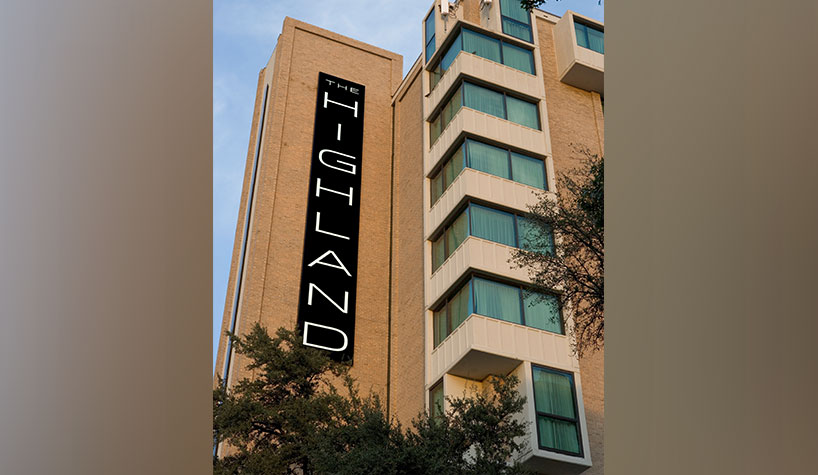

HFF Arranges Sale and Acquisition Financing of The Highland Dallas Curio hotel

HFF has arranged the sale of and acquisition financing for The Highland Dallas Curio, a 198-room luxury hotel located in Dallas. The HFF team marketed the property on behalf of the seller. Lennox Capital Partners purchased the hotel and brought in HEI Hotels & Resorts for management of the property going forward. Additionally, working on behalf of the new owner, the HFF team placed the five-year, floating-rate loan with a European bank.

CHC Secures $8.7M Refinance for Courtyard in El Paso, TX

CHC has arranged $8.7 million for the refinance of the Courtyard – El Paso, TX. The loan was placed with a national lender and offered a 10-year term and 30-year amortization. The rate was locked at 5.04%.

Mag Mile Capital Finances $32.05M for Three Hotel Properties

Mag Mile Capital has arranged financing for three hotel properties including a Holiday Inn Express in South Carolina, a Hampton Inn & Suites in California and an IHG select-service hotel, also in California. The loans were originated by associate VP Suraj Desai and serviced and closed by Ian Carlos, Mac Dobson and Heather Madsen, respectively. In the first transaction, the firm completed a $7.25-million CMBS, non-recourse loan for the Holiday Inn Express, located at 722 US-17 in North Myrtle Beach, SC.

Mag Mile Capital also orchestrated a $15.1-million construction loan for a new Hampton Inn & Suites to be located off of exit 172 on route 101 in Santa Maria, CA. The planned 110-key hotel was financed through an SBA 504 loan and is slated to begin construction this month. The loan featured an 80% loan-to-cost ratio.

Also, in California, Mag Mile Capital closed a $9.7-million non-recourse CMBS loan for an IHG select-service hotel. The borrower will use the funds for future investments and to complete the current PIP.

Lodging Partners Arranges Sale of Quality Inn & Suites, Myrtle Beach, SC

Lodging Partners LLC has arranged the sale of the 96-guestroom Quality Inn & Suites located on US-501 in Myrtle Beach, SC. Ford Barton, managing principal of Lodging Partners, exclusively marketed the property and arranged the sale on behalf of the seller.

Walker & Dunlop Structures $25M in Financing for Boutique Hotel in North Carolina Market

Walker & Dunlop has structured $25 million in financing for Aloft Asheville, a specialty hotel property located in Asheville, NC. The 115-key property is owned and was developed by McKibbon Hospitality.