INTERNATIONAL REPORT—New data released from OTA Insight highlights the root cause of rate parity issues. OTA Insight delivers key findings from its data-driven infographic, “The Real Rate Parity Problem No One is Talking About,” along with the release of its Annual Hotel Parity Review.

Findings from the infographic outline key root issues surrounding rate parity for hotels, such as wholesalers that break the chain of contracts between hotels and online travel agents (OTAs) by selling discounted rooms to non-contracted OTAs, effectively allowing them to undercut hotel room prices significantly. Additionally, the Annual Hotel Parity Review provides a benchmark for hoteliers to understand parity performance in different markets across Europe and North America.

Infographic Calls Out Industry Parity Problem

Most hoteliers recognize that they need a diverse mix of distribution channels to maximize their reach. However, it is becoming increasingly apparent that third-party sellers are not playing fair, and as a result, many hoteliers are suffering from huge losses in revenue while also undermining their direct sales and marketing efforts, the report found.

It was revealed that major North American hotel chains are negatively impacted 24% of the time by non-contracted OTAs, while major European chains are negatively impacted more than one-third (36%) of the time, according to the report. Additionally, these figures are much higher for independent hotels and local chains. The data highlights even more findings from OTA Insight’s own data:

- Top five undercutting wholesalers

- Top non-contracted OTAs that wholesalers are on-selling to

- A spotlight on parity issues and its impact around the world

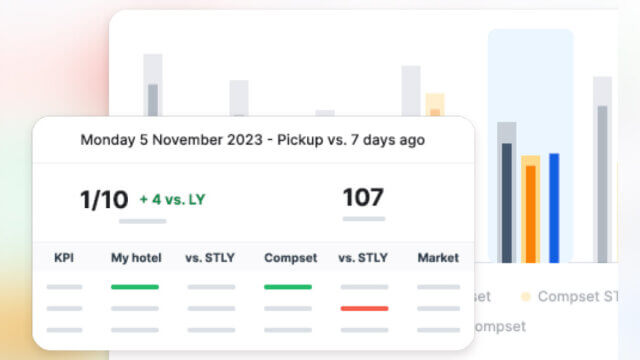

Annual Hotel Parity Report Provides Actionable Insights

Along with the infographic, the company’s Annual Hotel Parity Review examined the European and North American rate parity trends for 2018. In line with OTA Insight’s mission to help the hospitality industry visualize and leverage data, the report provides visibility into the differences between major chains (based on nine of the leading global hotel chains within the hospitality market) and independents and local chains (a range of independent properties and local market chain hotels). This level of transparency to the market allows hoteliers to come away with actionable insights on parity, showcasing how it affects them and their properties. Here are the key findings from the report across Europe and North America:

- In Europe: OTAs are more likely to be in parity with major chains than independents and local chains. Marketwide, there are significant parity loss issues with Independents and local chains facing losses for 53% of tracked shops in comparison to 45% for major chains.

- In North America: OTAs are more likely to be in parity with major chains than independents and local chains. Marketwide, there are significant parity loss issues with Independents and local chains facing losses on 46% of tracked shops in comparison to 35% for major chains.