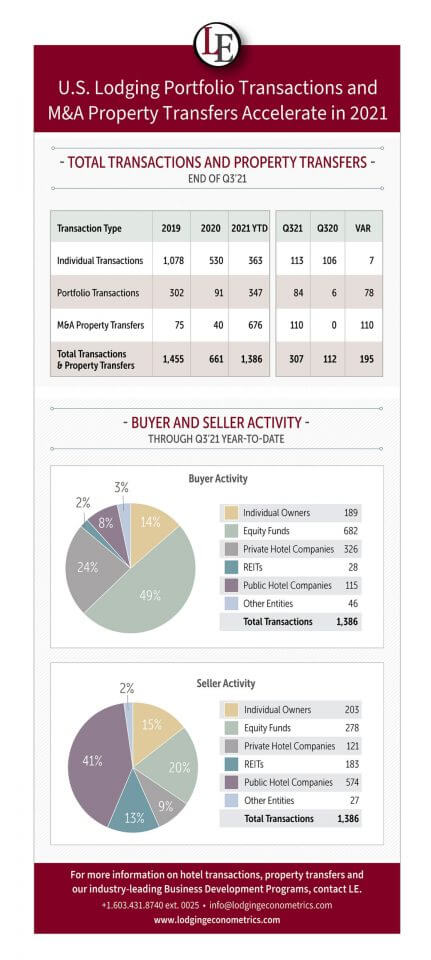

Through Q3 2021, the U.S. had a total of 1,386 hotels having 176,874 rooms change ownership. Of the 1,386 hotels that have sold, 1,023 (or 74%) of transactions were hotels sold as part of portfolio transactions and M&A property transfers. Twenty-four percent of portfolio transactions and 16% of M&A property transfers for 2021 occurred in Q3. Additionally, there have been another 363 individual transactions recorded for the year. Portfolio transactions and M&A property transfer volume is up substantially over the last two years.

In 2019, there were 302 portfolio transactions and only 91 in 2020, whereas, during the first three quarters of 2021 alone, there have been 347 portfolio transactions. The same goes for M&A property transfers. In 2019, the U.S. saw 75 hotel transfers, and in 2020 there were only 40. This year alone, through the first three quarters, there have been an astounding 676 M&A property transfers.

These substantial increases in 2021 are a result of a few major transactions including the 566-economy branded Extended Stay America merger transfer to the private equity group Eagle Parent Holdings LP, which is owned by Blackstone Real Estate Partners IX LP and Starwood Distressed Opportunity Fund XII Global LP. Twenty-three percent of the portfolio’s assets were in just seven markets. Each of the following markets had 15 or more hotels included in the sale: Chicago; Washington, D.C.; Atlanta; Los Angeles; Detroit; Orlando; and Raleigh-Durham.

Another notable deal driving these numbers up was the private hotel company Highgate Hotels scooping up 198 distressed hotel assets having 23,406 rooms from the private equity group DigitalBridge, formerly known as Colony Capital. DigitalBridge’s portfolio included 234 assets. Thirty-six of their assets went to the private equity group Kohlberg Kravis Roberts (KKR). Of the 198 hotels sold in this portfolio to Highgate, 75% of the hotels were Marriott branded.

Finally, the filing of bankruptcy by the real estate investment trust Hospitality Investors Trust left 110 hotels accounting for 13,596 rooms up for sale, which public hotel company Brookfield Asset Management acquired.

Private equity groups and private hotel companies, as buyers, have led the purchasing charge in 2021, accounting for 1,008 of the 1,386 total hotels purchased thus far in 2021. This includes both individual hotel transactions as well as portfolio transactions and M&A transfers.

Portfolio and M&A transfer activity is expected to remain strong over the next few quarters as lenders continue to pressure borrowers to sell or liquidate assets. Larger investment and hotel companies, who have the availability of capital, are set to take advantage of these opportunities.

Purchase LE’s Transaction Database to receive the most current and accurate hotel transaction information available in the industry, which includes date sold, selling price, average price per room, and buyer and seller contact information. We also can provide you with a comprehensive 20+ year historical review of trends and transaction volume, integral to understanding the right time to buy, sell, hold, reinvest, or refinance. For more information, please contact LE: (603) 431.8740, ext. 0025 or [email protected].

JP Ford, ISHC, SVP, Director of Global Business Development, Lodging Econometrics

Bruce Ford, SVP, Director of Global Business Development, Lodging Econometrics

Tom O’Gorman, Vice President of Sales, Lodging Econometrics

April Bedell, Sales Account Executive, Lodging Econometrics