According to the latest reports from Lodging Econometrics (LE), the industry leader for global hotel intelligence and decision maker contacts, the total U.S. Hotel Construction Pipeline at the close of the second quarter of 2021 stands at 4,787 projects/598,111 rooms.

Projects currently under construction are at 1,165 projects/159,581 rooms. Projects scheduled to start construction in the next 12 months total 1,843 projects/213,744 rooms. Projects in the early planning stage saw a 25% increase in projects and a 28% increase in rooms YOY, standing at 1,779 projects/224,786 rooms. The increase in projects in the early planning stage reflects a combination of developer’s confidence to initiate new construction projects and the recalibration of some of their timelines for existing projects.

Not only are new construction projects moving forward, but hotel owners are reestablishing renovation plans, and/or repositioning their properties with a brand conversion; while many others have already used the operational downtime caused by COVID-19’s impact as an opportunity to do so. New construction, announced renovation and brand conversion activity in the top 51 markets is substantial.

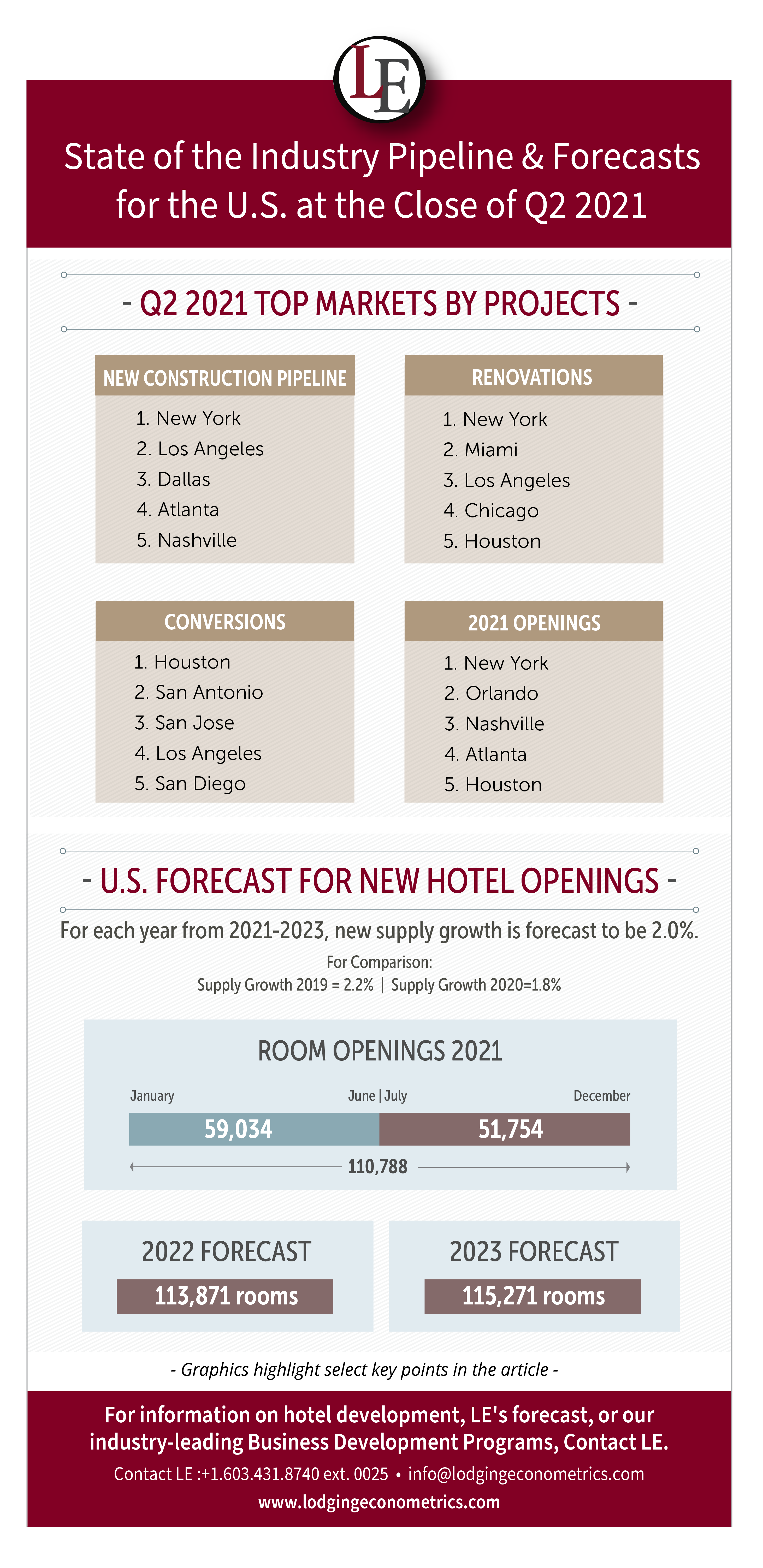

Forty percent of the top 51 markets have 50 or more new hotel construction projects in their pipelines. The top five markets with the largest hotel construction pipelines are New York City, with 146 projects/25,232 rooms; Los Angeles with 135 projects/22,586 rooms; Dallas with 132 projects/16,183 rooms; Atlanta with 129 projects/17,845 rooms; and Nashville with 91 projects/12,703 rooms.

The markets with the largest combined number of renovations and conversions in the second quarter of 2021 are New York City with 25 projects/7,957 rooms, followed by Houston with 24 projects/3,549 rooms, Los Angeles with 24 projects/3,423 rooms, Chicago with 20 projects/2,803 rooms, and Miami with 19 projects/2,305 rooms.

At the Q2 ’21 close, announced renovations currently stand at 552 projects/112,638 rooms. Slightly more than half of the renovation activity in the U.S. during the second quarter occurred in the top 51 markets, with 286 projects/70,442 rooms. In these top markets, 52% of the renovation projects in already underway, and another 34% are scheduled to start in the next 6 months. The top markets with the most renovation activity in the U.S. at the close of Q2 ’21, include New York City and Miami, both with 16 projects; followed by Los Angeles with 14 projects; Chicago with 13 projects; and Houston; Washington, DC; and Dallas, all with 9 projects each.

Brand conversions, at the close of Q2 ’21, stand at 583 projects/63,807 rooms. Markets with the highest number of brand conversions include Houston with 15 projects accounting for 1,877 rooms; San Antonio with 10 projects/1,812 rooms; San Jose, CA with 10 projects/1,144 rooms; Los Angeles with 10 projects/761 rooms, San Diego with 9 projects/1,410 rooms; New York City with 9 projects/1,292 rooms; and Washington, DC with 9 projects/1,220 rooms. LE is forecasting that renovation and conversion activity will continue to be robust going forward, as renovation extensions issued in 2020 due to COVID-19 will come due.

LE is forecasting a supply growth rate of 2% each year through 2023. During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms. LE is forecasting another 450 projects/51,754 rooms to open during 2021 for a total of 922 projects/110,788 rooms by year-end. 1,008 projects/113,871 rooms are expected to open in 2022. And, announcing for the first time this quarter is LE’s forecast for 2023, whereby LE is expecting 997 projects/115,271 rooms to open.

Hotels forecast to open in 2021 are led by New York City with 59 projects/8,583 rooms for a 7.2% supply increase; followed by Orlando with 22 projects/ 3,555 rooms for a 2.6% supply increase; Nashville with 22 projects/2,938 rooms for a 5.7% supply increase; Atlanta with 22 projects/2,930 rooms for a 2.7% supply increase; and Houston with 22 projects/2,470 rooms for a 2.7% supply increase.

In 2022, the New York City market is forecast to, again, top the list of new hotel openings with 46 projects; followed by Atlanta with 36 projects; then Los Angeles and Austin with 26 projects each, and Dallas with 24 projects. LE’s forecast for new hotel openings for 2023 shows Dallas is anticipated to lead new hotel openings with 35 projects/4,013 rooms for a 4% supply increase. Dallas is followed by Atlanta with 25 projects/3,247 rooms for a supply increase of 2.9%; Phoenix with 24 projects/3,290 rooms and a 4.5% supply increase; New York City with 21 projects/4,245 rooms for a 3.1% supply increase; and Los Angeles with 20 projects/2,355 rooms accounting for a 2.1% supply increase.

Lodging Econometrics (LE) can provide a comprehensive look into any market in the U.S. or any market around the world. LE has the most accurate and comprehensive intelligence on the hotel construction pipeline by stage, new project announcements, announced renovations, brand conversions, and open and operating hotels. We deliver this information in our comprehensive and accurate Database of Hotel Records. All records are completed with contact information for developers, ownership and management groups, and project team members, as announced. For more information, please contact LE: (603) 431.8740, ext. 0025 or [email protected].

JP Ford, ISHC, SVP, Director of Global Business Development, Lodging Econometrics

Bruce Ford, SVP, Director of Global Business Development, Lodging Econometrics

Tom O’Gorman, Vice President of Sales, Lodging Econometrics

April Bedell, Sales Account Executive, Lodging Econometrics

Carlos Quiñones, Account Manager, Lodging Econometrics