NATIONAL REPORT—Third quarter results continued to disappoint—once again coming in below expectations, with RevPAR growth of just 0.7%, according to PwC’s “U.S. Hospitality Directions” report for November.

Lodging supply growth outpaced demand in the quarter, resulting in a 0.1% decline in occupancy levels. A slight increase in transient demand failed to offset declines in the group and contract segments. While RevPAR increased during the quarter, it was the lowest year-over-year growth since the beginning of the U.S. lodging industry’s recovery from the Great Recession, and the only quarter in the current lodging cycle with a RevPAR increase below 1%.

“Challenges to the outlook include tempered investor confidence and political uncertainty both domestically and abroad, leading up to the presidential election,” stated Warren Marr, U.S. hospitality & leisure managing director, PwC.

Trends and highlights

Although U.S. hotels have experienced RevPAR increases in 112 of the last 115 months, growth continues to decelerate, with two of the three declines coming in June and September of this year. Looking ahead to the final quarter of 2019, the near-term lodging outlook suggests continued deceleration in top-line metrics. Weak demand and a general lack of pricing power in October supports this outlook.

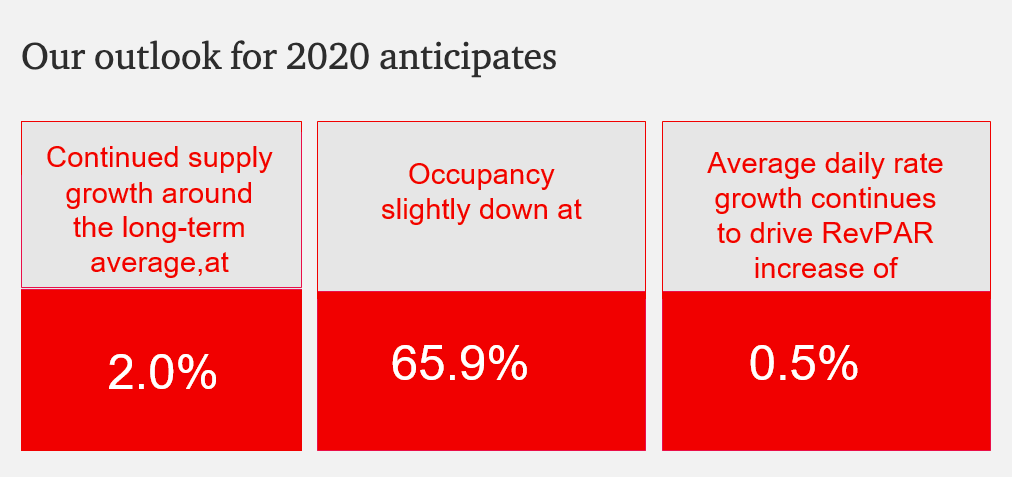

In 2020, despite an expected boost to lodging demand from the upcoming presidential election, supply is expected to exceed demand growth, resulting in a minor decrease in occupancy levels. Rising inflation is expected to help support what is still expected to be decelerating ADR growth, resulting in a marginal RevPAR increase of 0.5%.