TYSONS, VA—Park Hotels & Resorts Inc. has reported its results for the first quarter ended March 31, 2020, citing drops in RevPAR and occupancy attributable to the COVID-19 pandemic.

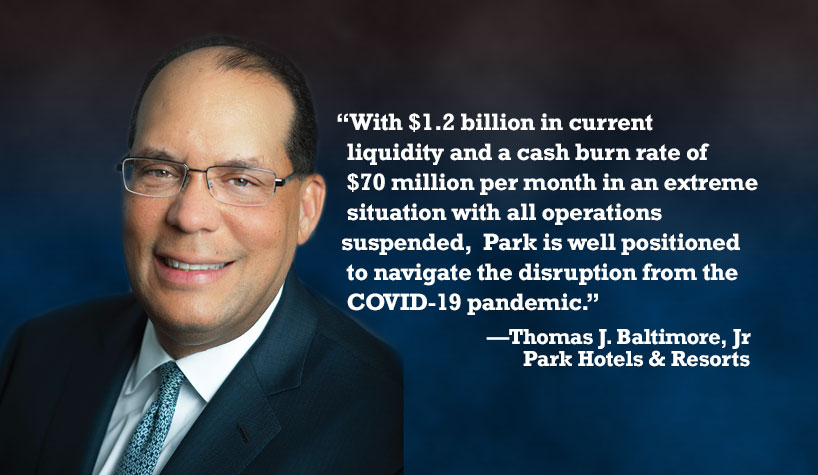

“Life as we know it has been adjusted,” said Thomas J. Baltimore, Jr., chairman/president/CEO in an earnings call. During the call, Baltimore noted that Park was quick to respond to the crisis by showing off its balance sheet and aggressively cutting costs across its portfolio.

He also said that Park remains focused on three points: First, its primary goal to realize the synergies through the Chesapeake acquisition; second, remaining focused on improving the overall value of portfolio through asset sales; and finally, reducing debt. Baltimore believes Park is still on track to realize all of these goals.

“I am proud of the focused and proactive efforts of the Park team and our operating and lending partners during this quarter as we worked together to respond to the unprecedented impact of the COVID-19 pandemic to our business,” Baltimore said. “In addition to suspending operations at over half of the hotels in our portfolio in March, and consolidating operations at hotels that remain open, we proactively drew our $1 billion Revolver prior to the end of the quarter, giving us considerable financial flexibility to weather this extremely challenging operating environment.

“With our portfolio currently operating with only 15% of our rooms available, we have reduced hotel operating expenses by approximately 75% at the current occupancy levels and reduced our 2020 CapEx budget by approximately 75%,” he added. “Additionally, last week, we amended our credit and term loan facilities to waive certain debt covenants through and including March 31, 2021, and extended the maturity of our revolving credit facility to December 2021. We received a unanimous vote from the syndicate of banks on the extension, highlighting the strong partnership and support we enjoy with our bank group.

“Our management team has managed several disruptive events throughout our careers, including natural disasters, 9/11 and the Great Recession. With $1.2 billion in current liquidity and a cash burn rate of $70 million per month in an extreme situation with all operations suspended, Park is well positioned to navigate the disruption from the COVID-19 pandemic,” he said.

Financial Results

Pro-forma RevPAR was $136.27, a decrease of 22.6% from the same period in 2019; Pro-forma Total RevPAR was $218.17, a decrease of 20.2% from the same period in 2019; net loss was $689 million (compared to $97 million from the same period in 2019) and net loss attributable to stockholders was $688 million (compared to $96 million from the same period in 2019), including a $607 million non-cash impairment loss related to goodwill allocated to Park from Hilton in the spin-off and $88 million of non-cash impairment losses related to long-lived assets, primarily associated with one hotel; and Pro-forma occupancy was 61.7% a decrease of 77.7% from the same period in 2019 (a 16% decrease).

Adjusted EBITDA was $82 million, a decrease of 53.4% from the same period in 2019; Adjusted FFO attributable to stockholders was $57 million, a decrease of 58.1% from the same period in 2019; Diluted loss per share was $2.89 (compared to $0.48 from the same period in 2019); and Diluted Adjusted FFO per share was $0.24 a 64.2% decrease from the same period in 2019.

Additional Highlights

- Completed the sales of the Embassy Suites Washington, DC and Park’s interests in the Hilton São Paulo Morumbi in February 2020 for total gross proceeds of $208 million

- Suspended operations at 38 of the company’s 60 hotels due to disruption from COVID-19, along with the consolidation of operations at other hotels that remain open further reducing rooms currently available to 15% of full capacity

- Fully drew on the company’s $1 billion revolving credit facility (“Revolver”) as a precautionary measure, resulting in a cash and restricted cash balance of $1.3 billion as of March 31, 2020, of which $105 million was used to pay Park’s April 15, 2020 dividend payment

- In May 2020, the company amended its credit and term loan facilities to suspend all financial covenants through March 31, 2021, and exercised options to extend the Revolver maturity date to December 2021

- Implemented actions to preserve cash, including establishing a baseline cash burn rate of approximately $70 million per month assuming all hotels have suspended operations

COVID-19

Park believes that demand will continue to be significantly reduced as a result of travel restrictions and social distancing, and that government restrictions and economic slowdown will significantly affect Park’s business. Park currently expects April and May to be the low point of operational performance, with RevPAR declines of 90% or more, and the second quarter overall to be the most challenged. As a result of the impact to its business from COVID-19, Park has recognized impairment losses during the first quarter of $695 million, including fully impairing the $607 million of remaining goodwill allocated to Park from Hilton in the spin-off and $88 million of long-lived assets primarily related to one hotel.