NATIONAL REPORT—The U.S. Hotel Construction Pipeline kicked off the first quarter of 2019 with 5,647 projects/687,941 rooms, up a strong 7% by projects and 8% by rooms year-over-year (YOY), according to analysts at Lodging Econometrics (LE). In comparison to the highest pipeline level ever recorded by LE, the current quarter is just a mere 236 projects, or 4% beneath the peak. In its seventh consecutive year of growth, LE anticipates the U.S. Hotel Construction Pipeline to continue to marginally grow through the end of 2019.

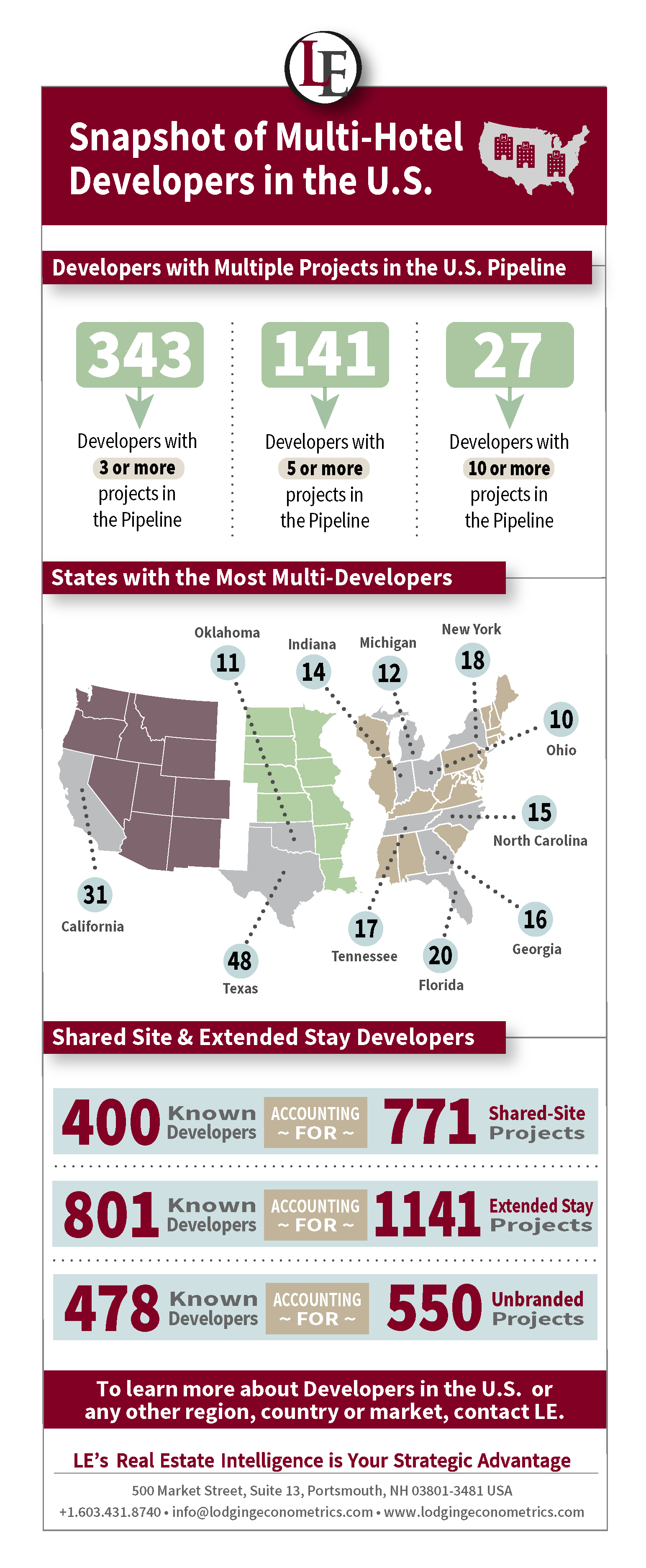

The last seven years of pipeline growth has spurred an incredible increase in the number of multi-development groups in the industry, as well. There are currently 343 developers with three or more projects in the U.S. Hotel Construction Pipeline, this is a sizable 212% increase in the number of developers reported back in Q1 2012, when the pipeline reached its lowest point by projects and rooms of this real estate cycle. At the end of Q1 2019, there were 141 developers having five or more projects in the pipeline. For this same quarter in 2012, there were only 51. Additionally, there are currently 27 developers with 10 or more hotel projects, whereas in 2012 there were eight.

The following states represent the areas with the highest concentration of multi-developers (three or more projects):

- Texas, with an impressive 745 total pipeline projects, the most of any state in the U.S., also with no surprise has the largest concentration of multi-developers with 48.

- The second largest state for both multi-developers and pipeline projects is California, with 31 developers.

- Florida follows with 20 developers. Florida also has an impressive 480 projects in the pipeline.

- In New York, there are 18 developers who have three or more projects, this is slightly less than the number a year ago.

- And, rounding out the top five states, is Tennessee, with 17 developers. Tennessee also has 222 projects in the pipeline.

Year-over-year, the number of both shared-site and extended stay developers and projects has increased substantially. There are currently 400 developers who have shared-site projects in the U.S. in their portfolio, this is a 10% increase in the number of developers of these projects over this same time last year. The top combination of brands for shared-sites are: MainStay Suites with Sleep Inn, Home2Suites by Hilton with Tru by Hilton, Courtyard by Marriott with Residence Inn, Fairfield Inn with Townplace Suites, and Hilton Garden Inn with Homewood Suites by Hilton.

There are currently 801 known developers of extended stay projects in the U.S. This is a 5% increase in the number of developers YOY. The top three brands in the pipeline are: Home2 Suites by Hilton, Residence Inn, and Towneplace Suites. These 3 brands alone account for 55% of the extended stay projects in the pipeline.

Overall, hotel development and the rush for developers to get their projects to fruition continues, and we expect it to continue through the end of 2019.

For more information on hotel development groups or development activity in the U.S. or any other region, country or market worldwide, please contact Lodging Econometrics phone: (603) 431-8740 or email: [email protected]. LE is the global leader for hotel real estate intelligence.

—JP Ford, SVP, director of business development, Lodging Econometrics

—Bruce Ford, SVP, director of global business development, Lodging Econometrics

—Tom O’Gorman, VP of sales, Lodging Econometrics

—April Bedell, sales account executive, Lodging Econometrics