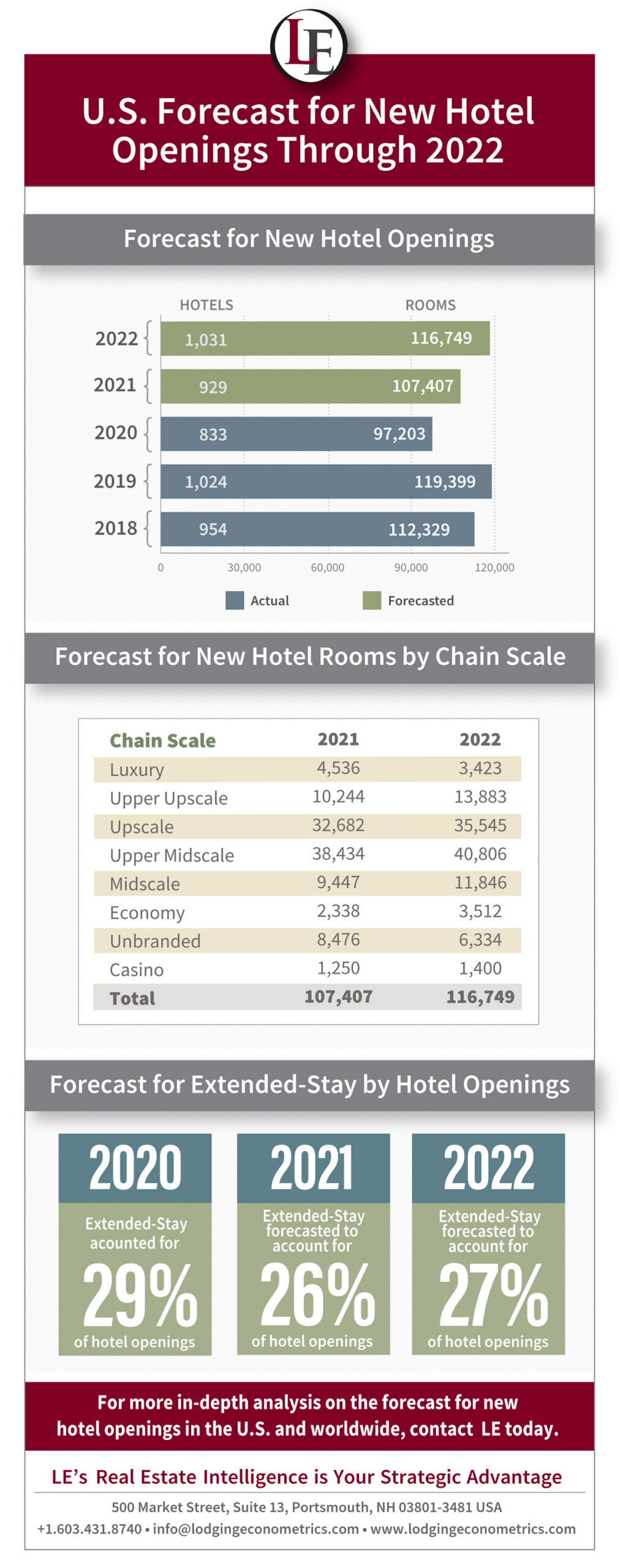

In the fourth quarter of 2020, even as the United States grappled with the ongoing coronavirus pandemic, the approval and rollout of vaccines, an election, civil unrest, and the large and rapid partisan shift, hotel development continued to move forward. According to recently released reports from Lodging Econometrics (LE), through year-end 2020, the U.S. opened 833 projects accounting for 97,203 rooms, bringing the U.S. supply of open & operating hotels to 58,569 hotels/5,557,119 rooms. Currently, the U.S. construction pipeline stands at 5,216 projects/650,222 rooms. LE is forecasting another 929 projects/107,407 rooms to open by year-end 2021. For 2022, LE is forecasting 1,031 projects/116,749 rooms to open.

Of the 833 projects that opened in 2020, upscale and upper midscale brands accounted for an impressive 68% of the new openings and 63% of the new rooms. These two chain scales have brands that have dominated the U.S. construction pipeline throughout the past decade because of their wide consumer appeal for both business and leisure travelers. These upscale and upper midscale brands have strong reservation systems and loyalty programs, their food and beverage components are easily manageable, and lenders like them.

Extended-stay brands, impressively, accounted for 29% of all hotels that opened in 2020. The middle tier extended-stay brands accounted for the most openings with 141 hotels/14,347 rooms, equating to a 10.3% growth rate. For 2021, extended-stay brands are projected to open 241 projects/25,779 rooms or 26% of all forecasted openings for that year. And, in 2022, extended stay brands are expected to open 280 of the 1,031 forecasted openings, accounting for 27% of all projects to open.

The top five brands with the most hotel openings in 2020 were Home2 Suites by Hilton, Holiday Inn Express, Tru by Hilton, Fairfield Inn, and TownePlace Suites. These same brands are expected to open the most projects in 2021. Home2 Suites is forecast to open 74 projects, Holiday Inn Express with 66 projects, Fairfield Inn with 57 projects, Tru by Hilton with 41 projects, and TownePlace Suites with 33 projects.

The top five markets that opened the most hotels in 2020 were Houston with 22 hotels/1,823 rooms, Dallas with 21 hotels/2,776 rooms, Atlanta with 19 hotels/2,178 rooms, Nashville with 18 hotels/3,158 rooms, and Charlotte with 17 hotels/2,060 rooms. In 2021, the top markets with the most forecasted hotel openings include New York with 65 projects/8,578 rooms, Houston with 25 projects/2,828 rooms, Dallas with 23 projects/2,431 rooms, Atlanta with 22 projects/2,909 rooms, and Los Angeles with 21 projects/3,608 rooms.

For more information on LE’s forecast for the lodging industry, please contact us. LE can help you understand new hotel supply additions for any city or market around the world, or by chain scale, franchise company and brand. We can deliver this information along with new construction projects, announced renovations, brand conversions, and the census of open & operating hotels in our Online Database of Hotel Records. All records are completed with contact information for developers, ownership and management groups, and project team members, as announced.

Phone +1 603.841.8740 ext. 0025 or email [email protected].

JP Ford, ISHC, SVP, Director of Global Business Development, Lodging Econometrics

Bruce Ford, SVP, Director of Global Business Development, Lodging Econometrics

Tom O’Gorman, Vice President of Sales, Lodging Econometrics

April Bedell, Sales Account Executive , Lodging Econometrics

Carlos Quiñones, Account Manager, Lodging Econometrics