MCLEAN, VA—Hilton President/CEO Christopher J. Nassetta is touting the hotel brand’s results for third quarter 2018.

“We delivered solid third quarter results, as our resilient business model drove adjusted EBITDA to the high end of guidance and diluted EPS, adjusted for special items, above expectations,” said Nassetta. “Calendar shifts and weather impacts tempered reported RevPAR growth, but fundamentals remain strong. We continue to feel optimistic about overall demand trends for the balance of the year and into 2019. Additionally, we are excited to expand our global presence with the launch of Motto by Hilton, our new urban, lifestyle micro-hotel brand.”

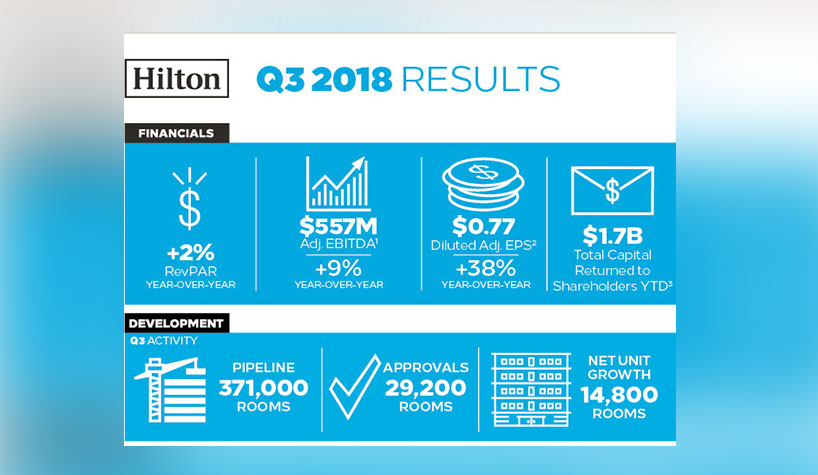

For the three and nine months ended Sept. 30, system-wide comparable RevPAR grew 2% and 3.3%, respectively, primarily driven by increased ADR. In particular, strength at Hilton’s international hotels benefited results in both periods, particularly in the Europe and Asia Pacific regions. Management and franchise fee revenues increased 10% and 11% during the three and nine months ended Sept. 30, 2018, respectively, as a result of RevPAR growth of 1.8% and 3.2%, respectively, at comparable managed and franchised hotels, increased license and other fees and the addition of new properties to Hilton’s portfolio.

For the three months ended Sept. 30, 2018, diluted EPS was $0.54 and diluted EPS, adjusted for special items, was $0.77 compared to $0.49 and $0.56, respectively, for the three months ended Sept. 30, 2017. Net income and Adjusted EBITDA were $164 million and $557 million, respectively, for the three months ended Sept. 30, 2018 compared to $160 million and $511 million, respectively, for the three months ended Sept. 30, 2017.

For the nine months ended Sept. 30, 2018, diluted EPS was $1.76 and diluted EPS, adjusted for special items, was $2.01 compared to $1.08 and $1.45, respectively, for the nine months ended Sept. 30, 2017. Net income and Adjusted EBITDA were $544 million and $1,557 million, respectively, for the nine months ended Sept. 30, 2018 compared to $359 million and $1.425 million, respectively, for the nine months ended Sept. 30, 2017.

Outlook for Q4 2018

- System-wide RevPAR is expected to increase between 2% and 3% on a comparable and currency neutral basis compared to the fourth quarter of 2017.

- Diluted EPS, before special items, is projected to be between $0.66 and $0.71.

- Diluted EPS, adjusted for special items, is projected to be between $0.66 and $0.71.

- Net income is projected to be between $199 million and $213 million.

- Adjusted EBITDA is projected to be between $518 million and $538 million.

- Management and franchise fee revenue is projected to increase between 9% and 11% compared to the fourth quarter of 2017.