NEW YORK—The coronavirus’s global spread will significantly slow economic growth, which will in turn amplify its financial impact on several key corporate sectors, Moody’s Investors Service said in a new global report.

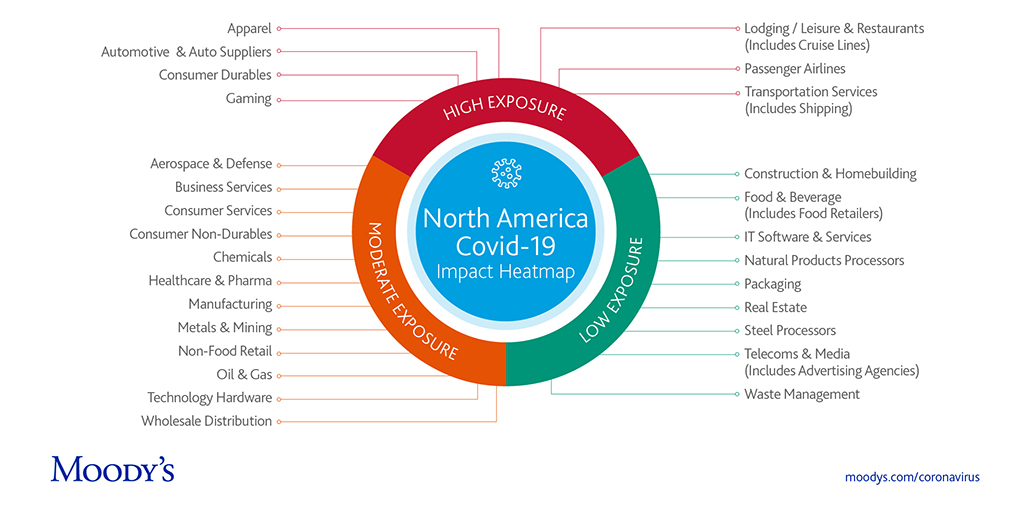

“Sectors reliant on trade and the free movement of people are most exposed, such as passenger airlines, shipping, and lodging & leisure, which includes cruise lines and restaurants,” said Benjamin Nelson, VP/senior credit officer/co-author of the report, Moody’s.

Global automakers are also under great pressure because of their reliance on international supply chains, while gaming and non-food retail in certain regions are also exposed to supply chain disruptions, and the inevitable decline in foot traffic.

“Companies’ ability to withstand the effects of the virus will depend on its duration, and we caution that as events unfold very rapidly on a daily basis, our assessment of exposure will change over time,” said Richard Morawetz, VP/senior credit officer/co-author of the report, Moody’s.

Moody’s assessment is based on its baseline scenario, which assumes a normalization of economic activity in the second half of the year; the ability of some companies to withstand the effects of the virus will depend on its duration. Moody’s downside scenario factors in a jump in cases and public fear that the virus will not be contained in the first half of 2020, leading to extensive and prolonged travel restrictions and quarantines, along with a prolonged slump in commodity prices.