NEW YORK—CBRE Hotels’ Americas Research provided its current thinking and outlook for the U.S. lodging industry at this year’s NYU International Hospitality Industry Investment Conference.

“U.S. hoteliers enjoyed an eighth consecutive year of increasing profits in this past year despite another slowdown in the rate of revenue growth,” said R. Mark Woodworth, senior managing director at CBRE Hotels’ Americas Research. “Specifically, total operating revenue increased by 2% in 2017 for the average hotel in the survey sample. Fortunately, by limiting the growth in operating expenses to 1.9%, managers at the Trends properties realized a 2.2% increase in gross operating profits (GOP) for the period.”

Woodworth provided a brief review of the current state of the factors that have characterized one or more of the last three industry contractions. CBRE found the following:

- Economic Recession: Recent readings from the Bureau of Economic Analysis reveal that the U.S. economy continues to expand at an attractive, albeit average, pace. Economists at CBRE Econometric Advisors do expect a slowing down of the economy in 2020, but a technical recession does not seem to be in the cards.

- High Energy Costs: While elevated levels of unrest in some of the oil-producing areas of the world and an upward trending U.S. dollar in Q2 2018 have caused world oil prices to rise, they remain well below the historical levels ($125 per barrel) that threaten lodging demand.

- Bubbles: Significant academic research focused on identifying the presence of bubbles in the economy reveals that you only know when you are in a bubble when it bursts.

“Some observers sense a bubble may be present in the stock market, while others think housing markets may have become overheated,” he said. “Our own sense is that neither situation warrants undo concern and that no bubbles are likely on the horizon.”

- Overbuilding: Net annual supply change nationally was 1.8% in 2017 according to STR Inc.—exactly equal to the STR long run average dating back to 1987. This amount is forecast to peak at 2% in 2018, and to remain roughly at this level through 2022 based on the June-August 2018 Hotel Horizons report. This level is well below the previous cyclical peak of 3.1% in Q1 2009.

“At the local level, we expect 36 of the 60 U.S. cities that comprise our Hotel Horizons forecast universe will realize an increase in supply above their long run average in 2018,” said Woodworth. “Within this group, however, we expect that only 10 markets—led by Nashville, Ft. Lauderdale and Los Angeles—will realize supply growth this year of more than twice their STR long run average. In total, we do not see a threat looming because of too much new supply too soon.”

- Black Swan Event: Two catastrophic events since the turn of the century—the terrorist attacks of September 11, 2001 and the Great Recession of 2008—both illustrated that dramatic declines in lodging performance are realized very quickly, and severely, when extraordinary, unanticipated actions such as these occur. There are many reasons to hope that nothing like this happens again.

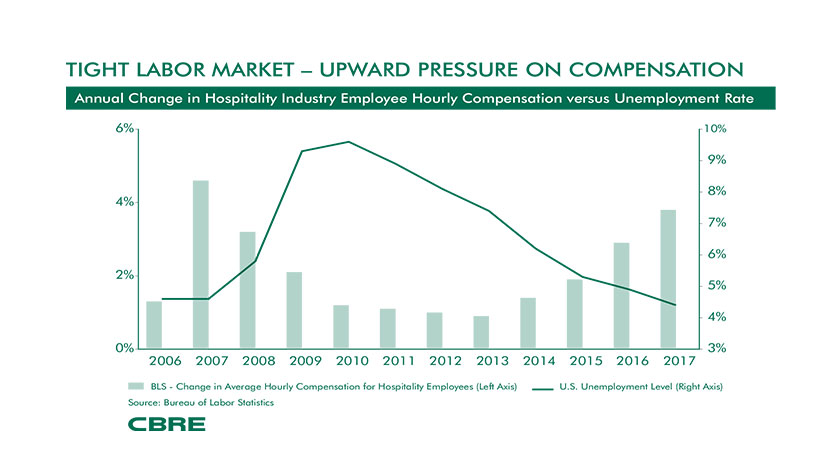

While the fundamentals are sound and portend a continued, protracted period of topline revenue growth, the expanding scarcity of labor in many markets around the country threatens commensurate levels of profit increases.

Labor Shortage

Labor and related expenses in the trends sample represented 42.4% of total expenses this past year. While managers were able to limit the year-over-year gain to 1.8% in 2017, this ability will likely be short lived as the unemployment rate continues to decline. These conditions are made worse by the laggard increases in the domestic labor force. Slow labor force growth is a result, in part, of decelerating growth of the civilian population, which the Bureau of Labor Statistics projects to grow at an annual rate of 0.9% from 2016 to 2026. This growth is slower than the rates witnessed during previous decades, 1% from 2006 to 2016, and 1.3% from 1996 to 2006.

Further, about nine out of 10 new jobs are projected to be added in the service-providing sector (including leisure and hospitality) from 2016 to 2026, resulting in more than 10.5 million new jobs, or 0.8% annual growth. Conversely, the goods-producing sector is expected to increase by only 219,000 jobs, growing at a rate of 0.1% per year over the projections decade.

“We expect that managing increases in labor and related expenses, combined with proactive efforts focused on enhanced productivity, will be an operator headline issue for many years to come,” he said.