VANCOUVER—American Hotel Income Properties REIT LP has reached a definitive agreement to acquire a portfolio of 12 premium-branded hotels for $191 million, excluding closing and post-closing adjustments.

The 12 hotels, totaling 1,203 guestrooms, are located across the U.S. and will significantly strengthen AHIP’s geographic presence in Texas and the Midwest, the company reports. The properties have all been constructed within the past five years, are stabilized and have minimal brand-mandated property improvement plans. The transaction is expected to close this month, at which point AHIP’s portfolio will consist of 79 premium-branded hotels, representing 8,887 total guestrooms, that are licensed primarily with Marriott, Hilton and IHG.

“We’re very excited to complete a significant component of our 2019 capital recycling program by adding these 12 high-quality, mostly all-suite focused, recently built select-service hotels to our portfolio of premium-branded hotels,” said John O’Neill, CEO, AHIP. “We’re especially pleased with the acquisition cap rate and short closing timeline for this transaction, as the cash flow from these newer hotels will minimize the dilution from the sale of the economy lodging portfolio. With no major capital renovations required, the hotels in this portfolio should perform without any income displacement. In addition, the improved debt financing terms we’ve secured for this transaction, including interest-only payments at lower fixed interest rates, will meaningfully reduce our financing costs and drive higher cash flows. We continue to believe higher-quality properties and attractive financing terms will drive better risk-adjusted FFO accretion and create value for our unitholders over the long term.”

AHIP intends to use net proceeds from the sale of its economy lodging portfolio, alongside an approximately $105 million new fixed-rate term loan, to finance the acquisition. Specifically, the facility will have a five-year term with fixed interest rates less than 4%, secured by the 12 new hotel properties. Exact debt terms will be confirmed at the time the acquisition closes. The hotels are being acquired for approximately $158,800 per key, which is below AHIP’s estimate of replacement cost.

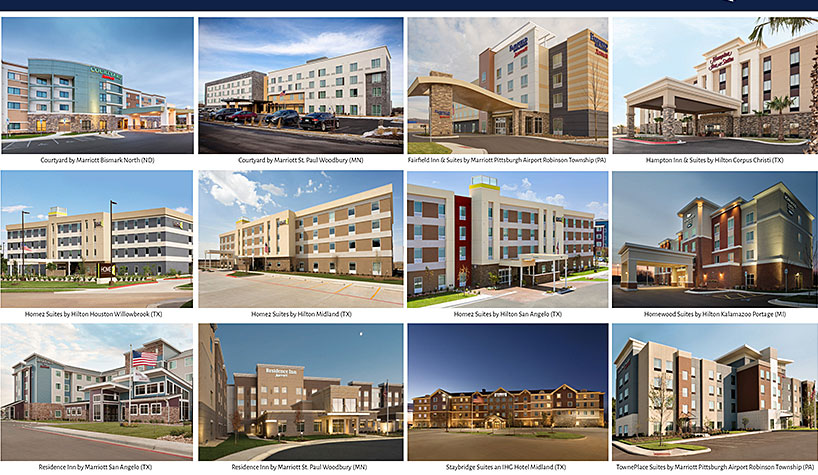

The 12 hotels in the acquisition include six Marriott-branded properties (two Courtyards, two Residence Inns, one Fairfield Inn & Suites and one TownePlace property), five Hilton-branded properties (three Home2 Suites, one Hampton Inn and one Homewood Suites), and one IHG-branded property (a Staybridge Suites). Eight of the 12 hotels are all-suite products, and all of these brands are complementary to AHIP’s existing hotel portfolio of select-service, premium branded, upper-midscale to upper-upscale properties. Importantly, all of the properties are already managed by Aimbridge Hospitality—AHIP’s exclusive hotel manager, which should ensure a seamless transition into AHIP’s portfolio, the company reports.

The acquisition also further diversifies AHIP’s geographic markets, strengthening the company’s presence in markets outside of the U.S. East Coast. Six of the new hotels are located in Texas, while the remainder are located in the Midwest (Michigan, Minnesota, North Dakota and Pennsylvania). In line with AHIP’s long-term strategy, all 12 hotels are located in metropolitan secondary markets that benefit from multiple demand generators and industries to support the local economies.

The Acquisition Portfolio

- Courtyard St. Paul Woodbury (Minneapolis), Woodbury, MN

- Residence Inn St. Paul Woodbury (Minneapolis), Woodbury, MN

- Home2 Suites Houston Willowbrook, Houston, TX

- Fairfield Inn & Suites Pittsburgh Airport Robinson Township, Pittsburgh, PA

- Hampton Inn & Suites Corpus Christi, Corpus Christi, TX

- Staybridge Suites Midland, Midland, TX

- Homewood Suites Kalamazoo Portage, Portage, MI

- Home2 Suites Midland, Midland, TX

- Home2 Suites San Angelo, San Angelo, TX

- TownePlace Suites Pittsburgh Airport Robinson Township, Pittsburgh, PA

- Residence Inn San Angelo, San Angelo, TX

- Courtyard Bismarck, North Bismarck, ND

Completion of Sale of Economy Lodging Portfolio

AHIP also closed the previously announced sale of its economy lodging portfolio of 45 hotels to VCM Ltd. (an affiliate of Vukota Capital Management), for total gross proceeds of $215.5 million, excluding closing and post-closing adjustments. This profitable sale culminates an extensive review of the portfolio that reinforced AHIP’s view that its long-term strategy is better focused on expanding and driving growth from its premium-branded, select-service hotel portfolio.

In connection with closing of this transaction, AHIP has agreed that approximately $7 million of the gross proceeds will be subject to an earn-out to be settled in the next 12 months based on the achievement of certain criteria. In addition, AHIP has agreed to pre-fund from the gross proceeds a maximum of $7.4 million of brand mandated property improvement plans for the economy lodging hotels with a credit for any cost savings.